Hsmb Advisory Llc for Dummies

Table of ContentsOur Hsmb Advisory Llc StatementsLittle Known Facts About Hsmb Advisory Llc.Hsmb Advisory Llc Can Be Fun For AnyoneMore About Hsmb Advisory Llc10 Simple Techniques For Hsmb Advisory LlcHow Hsmb Advisory Llc can Save You Time, Stress, and Money.

Ford claims to stay away from "cash money value or permanent" life insurance, which is more of an investment than an insurance coverage. "Those are extremely complicated, featured high compensations, and 9 out of 10 individuals do not require them. They're oversold due to the fact that insurance policy representatives make the biggest payments on these," he says.

Disability insurance policy can be pricey. And for those who choose for long-term care insurance coverage, this plan might make handicap insurance unneeded.

Excitement About Hsmb Advisory Llc

If you have a chronic health worry, this sort of insurance coverage might wind up being crucial (St Petersburg, FL Health Insurance). Nevertheless, don't let it stress you or your bank account early in lifeit's normally best to secure a policy in your 50s or 60s with the anticipation that you won't be using it till your 70s or later.

If you're a small-business proprietor, take into consideration safeguarding your resources by purchasing service insurance coverage. In case of a disaster-related closure or period of rebuilding, company insurance can cover your income loss. Think about if a substantial weather event impacted your storefront or production facilityhow would that affect your income? And for for how long? According to a record by FEMA, between 4060% of small companies never resume their doors following a disaster.

Plus, using insurance coverage could occasionally cost greater than it saves in the future. As an example, if you obtain a contribute your windscreen, you might consider covering the fixing expense with your emergency situation financial savings instead of your vehicle insurance. Why? Because using your vehicle insurance coverage can trigger your month-to-month premium to rise.

Rumored Buzz on Hsmb Advisory Llc

Share these ideas to safeguard liked ones from being both underinsured and overinsuredand speak with a trusted specialist when required. (https://filesharingtalk.com/members/593064-hsmbadvisory)

Insurance coverage that is purchased by a specific for single-person coverage or protection of a household. The individual pays the costs, instead of employer-based medical insurance where the company typically pays a share of the costs. Individuals might purchase and acquisition insurance from any kind of strategies available in the person's geographic region.

Individuals and households may qualify for financial help to reduce the expense of insurance premiums and out-of-pocket expenses, however only when enrolling via Attach for Wellness Colorado. If you experience specific modifications in your life,, you are eligible for a 60-day duration of time where you can sign up in a specific strategy, also if it is outside of the yearly open registration period of Nov.

15.

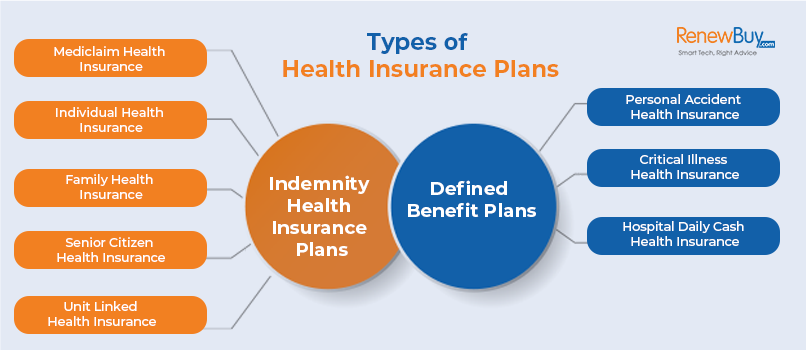

It might seem easy yet understanding insurance coverage types can likewise be puzzling. Much of this confusion comes from the insurance sector's recurring objective to develop individualized protection for insurance policy holders. In creating versatile policies, there are a selection his comment is here to pick fromand every one of those insurance policy kinds can make it tough to understand what a certain policy is and does.

Hsmb Advisory Llc Things To Know Before You Buy

If you pass away throughout this duration, the individual or people you have actually called as recipients may obtain the cash money payout of the policy.

However, many term life insurance coverage policies let you transform them to a whole life insurance policy policy, so you don't shed coverage. Typically, term life insurance policy plan premium settlements (what you pay per month or year into your policy) are not locked in at the time of purchase, so every 5 or 10 years you have the plan, your costs can climb.

They also have a tendency to be less expensive general than entire life, unless you purchase an entire life insurance policy plan when you're young. There are likewise a few variations on term life insurance policy. One, called group term life insurance coverage, prevails among insurance choices you may have accessibility to through your employer.

Hsmb Advisory Llc Fundamentals Explained

Another variation that you could have access to through your company is extra life insurance., or interment insuranceadditional protection that might aid your family members in situation something unanticipated occurs to you.

Irreversible life insurance coverage merely refers to any life insurance coverage policy that does not run out. There are a number of kinds of permanent life insurancethe most typical kinds being whole life insurance policy and universal life insurance. Whole life insurance is precisely what it seems like: life insurance policy for your whole life that pays to your recipients when you pass away.